Percentage taken out of paycheck

Learning how to work out a salary increase percentage will also help you to compare your compensation against others in your field. Use features like bookmarks note taking and highlighting while reading How to Stop Living.

Understanding Your 401 K Statement Finances Money Finance Investing Finance Saving

That 250 would be pulled for your insurance payment and youd pay taxes.

. Sixty years of separate but equal. If companies continue to hire and promote women to manager at current rates the number of women in management will increase by just one percentage point over the next ten years. This is the simpler method and it tells you the exact amount of money to withhold.

How many people have been vaccinated. Lets say you got a new job that pays 20hour. Thirty-five years of racist housing policy.

Take these steps to determine how much tax is taken out of a paycheck. You can print out completed copies of Forms W-2 to file with state or local governments distribute to your employees and keep for your records. Download it once and read it on your Kindle device PC phones or tablets.

But are companies start hiring and promoting women and men to manager at equal rates we should get close to parity in management48 percent women versus 52 percent. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. As of 2013 the top 1 of households the upper class owned 367 of all privately held wealth and the next 19 the managerial professional and small business stratum had 522 which means that just 20 of the people owned a remarkable 89 leaving only 11 of the.

Overview of New York Taxes New York state has a progressive income tax system with rates ranging from 4 to 109 depending on taxpayers income level and filing status. Ninety years of Jim Crow. If state income tax withholding applies to you your option to claim exemption depends on your state revenue agencys requirements.

For example Pennsylvania doesnt require employees to fill out a state tax form for state income tax withholding purposes. Federal government websites often end in gov or mil. What percentage of your paycheck do you actually get to keep.

These would be deducted from the gross wages before deducting taxes. That works out to 800 per week 3200 per month and 41600 per year--pretax. Instead they offer a percentage of compensation usually 50 to 60 of your weekly earnings with a dollar amount cap.

For example the more money you earn the more you pay in taxes. The amount of money you actually receive after tax withholding and other deductions are taken out of your paycheck is called your net income or take-home pay. The Percentage Method and Wage Bracket Method.

The amount taken out of an employees paycheck to pay for specific benefitsdonations the employee has chosen. Wage bracket method and percentage method. When you take advantage of your short-term disability benefit your time off is paidbut that doesnt necessarily mean youll be getting your full paycheck.

New research on the meaning of work shows that more than 9 out of 10 employees are willing to trade a percentage of their lifetime earnings for greater meaning at work. Qualified sick leave wages and qualified family leave wages for leave taken after March 31 2020 and before April 1 2021 arent subject to the. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes.

Two hundred fifty years of slavery. Simple Personal Finance Books Smart Money Blueprint - Kindle edition by Breyer Avery. The gov means its official.

Too many people fall into that trap and join the category of. More information is available from the Internal Revenue Service IRS at httpsappsirsgovapp. Some deductions are taken before taxes such as insurance and 401k.

However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed. Before sharing sensitive information make sure youre on a federal government site. How Much Money Gets Taken Out of Your Paycheck.

Thats why personal finance experts often advise that employees increase the percentage theyre saving for retirement when they get a raise so they dont experience a smaller paycheck and get discouraged from saving. Across age and salary. Making pre- and post-tax deductions will also impact how much is withheld from your paycheck.

Check out the latest stats to find out what percentage of Americans are millionaires. In the US 611 million doses administered with 151 million doses in the UK. Until we reckon with our compounding moral debts.

9 times out of 10 retirement withdrawals are taken out for people to buy a brand new car for immediate comfort or to pay off a credit card they maxed out that they will just wrack up again. The other 3240 is taken out of your paycheck for taxes and other deductions such as health insurance and retirement savings. Instead employers withhold at a flat percentage of all taxable wages.

How much tax is taken out of a paycheck. The money you contribute to a 401k plan will be deducted before taxes are taken out. This varies from person to person and location to location.

What Small Business Owners Need To Know For Payroll All of the information above can apply to both business owners and employees. For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month. And 894 million in Canada.

A proven path to money mastery in only 15 minutes a week. There are two federal income tax withholding methods for use in 2021. A paycheck to pay for retirement or health benefits.

For example if your employer has a 401k plan and you utilize it your contributions will come directly out of your paycheck. How to Stop Living Paycheck to Paycheck 2nd Edition. The other 3240 is taken out of your paycheck for taxes and other deductions such as health insurance and retirement savings.

Review current tax brackets to calculate federal income tax. Taken out of your paycheck into your decision. And he cited Bloombergs philanthropic giving offering the calculation that taken together what Mike gives to charity and pays in taxes amounts to approximately 75 of his annual income.

Going from paying 100month to 200month in insurance premiums for the same coverage would negate some of your salary increase for instance. A sample paycheck stub shows examples of what would be on an employees pay stub. Additionally state income tax rates vary.

In the United States wealth is highly concentrated in relatively few hands. The article in January 2013 detailed how the Russian atomic energy agency Rosatom had taken over a Canadian company with uranium-mining stakes stretching from Central Asia to the American West. Some plans offer full salary replacement but most dont.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Irs New Tax Withholding Tables

What Exactly Gets Taken Out Of Your Paycheck Tax Deductions Paycheck Payroll

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Paycheck

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Understanding Your Paycheck Credit Com

5 Ways To Use Your Tax Refund To Establish Financial Confidence Infographic Tax Refund Infographic Finances Money

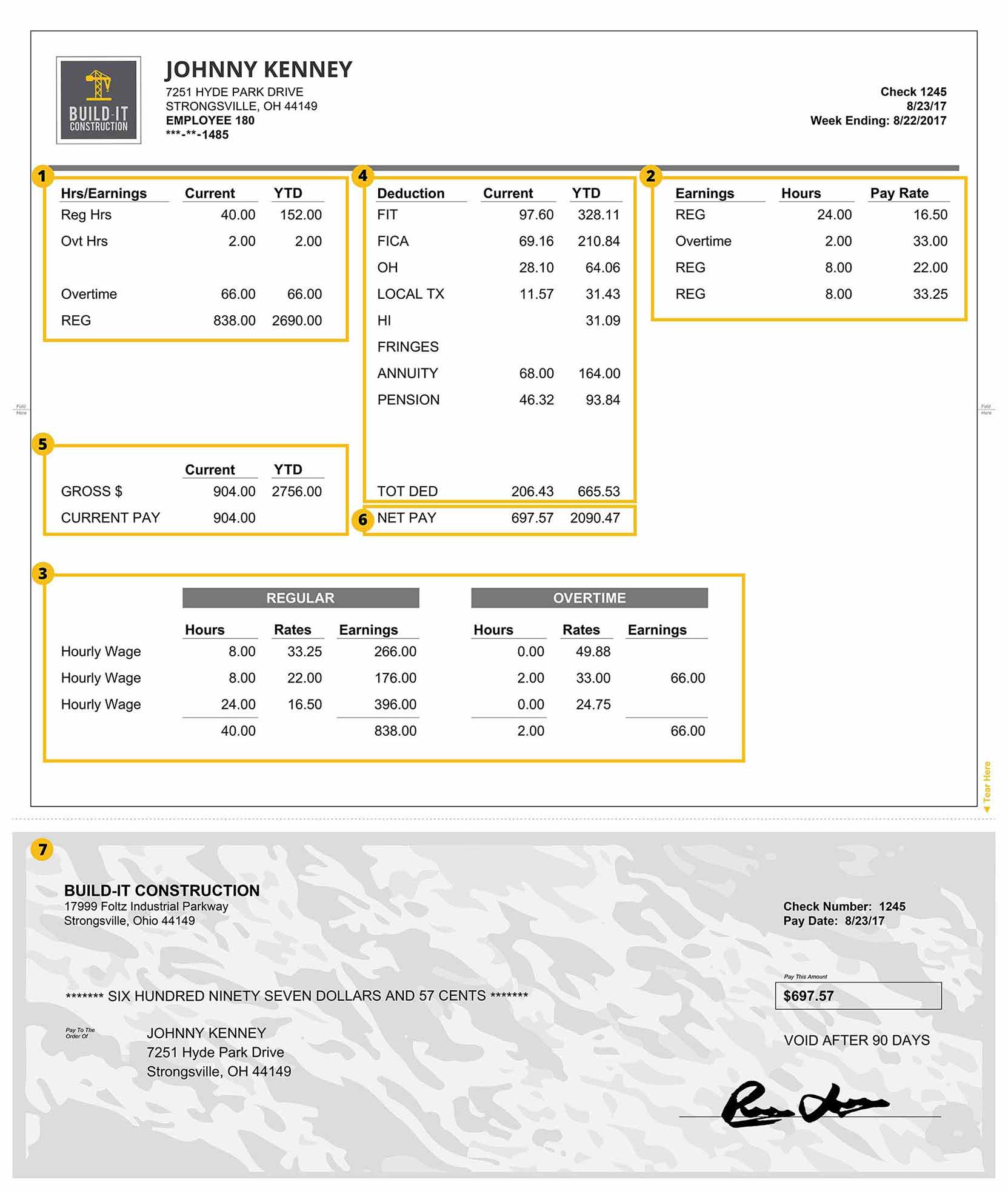

A Construction Pay Stub Explained Payroll4construction Com

Decoding Your Paystub In 2022 Entertainment Partners

2022 Federal State Payroll Tax Rates For Employers

The Number Of Consumers Living Paycheck To Paycheck Has Increased Year Over Year Across All Income Levels

Paycheck Calculator Online For Per Pay Period Create W 4

What Are Payroll Deductions Article

Free Printable Paycheck Stub Templates Pay Template Canada Inside Free Pay Stub Template Word Cumed O Word Template Payroll Template Templates Printable Free

Free Online Paycheck Calculator Calculate Take Home Pay 2022